Archive

Canada/US Exchange Rate

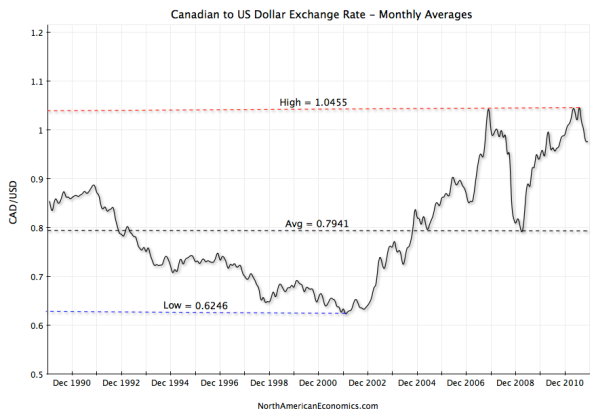

The exchange rate between the US and Canada has varied widely over the last few decades. Looking at monthly averages since 1990, the Canadian dollar has ranged from a low of 62 cents in February 2002 to a high of $1.04 in July 2011 with the average over the 22 year period being 79 cents.

Is there any way to determine what this rate should be in order to know when the time is right for cross-border investing? As Warren Buffett says, “Price is what you pay. Value is what you get.” The current exchange rate reflects the relative price of the two currencies. The goods and services each currency can buy reflects their values. As with all assets, when the price of a currency is low relative to its value, it’s a good time to buy. But how do you determine the value of a currency? One of the most popular ways is by using Purchasing Power Parity (PPP).

PPP is an attempt to calculate the exchange rate which results in equal buying power for each currency. For example, if a basket of goods costs $100 CAD in Canada and that same basket of goods costs $85 USD in the United States, both currencies will have the same purchasing power with an exchange rate of $1.0 CAD per $0.85 USD. In this situation, if the actual exchange rate were $1.0 CAD per $1.0 USD, then the Canadian dollar would buy 17.6% more than the US dollar – implying that the CAD is 17.6% overvalued.

Each month, the Organization of Economic Cooperation and Development (OECD) calculates PPP for each of the OECD countries. Their latest data indicate the current exchange rate should be $1.0 CAD per $0.78 USD – coincidentally this is almost the same as the average exchange rate since 1990. At the time of this writing, the actual exchange rate is $1.0 CAD per $0.97 USD implying the Canadian dollar is 24% overvalued.

Although there are different methodologies for computing PPP and no method is completely accurate, 24% is significant. Additionally, since the current value of the CAD is also 23% above its 22-year average, it’s safe to say it’s a good time for Canadians to be buying US assets – and a good time for Americans to be selling Canadian.